PTRC & PTEC in Maharashtra

What is PTRC & PTEC ?

In Maharashtra, businesses and professionals must register for Professional Tax under the Maharashtra State Tax on Professions, Trades, Callings, and Employments Act, 1975. There are two types of registrations:

PTEC (Professional Tax Enrollment Certificate) – For self-employed individuals, businesses, and professionals (doctors, lawyers, CA, etc.).

PTRC (Professional Tax Registration Certificate) – For businesses/employers who deduct and pay professional tax on behalf of employees.

Who Needs PTRC & PTEC in Maharashtra?

PTEC :

Who Needs It?

Self-employed professionals & business owners

Requirement:

If earning income from business or profession in Maharashtra

PTRC:

Who Needs It?

Businesses employing staff & deducting professional tax

Requirement:

If employing staff with salary above Rs. 7,500/month

Professional Tax Rates in Maharashtra

Employers must deduct professional tax from salaries as per the following slab:

For Employees (PTRC)

Monthly Salary - Up to Rs. 7,500

PT Payable Per Month - Nil

Monthly Salary - Rs.7,501 To Rs.10,000

PT Payable Per Month - Rs. 175

Monthly Salary - Above Rs.10,000

PT Payable Per Month - Rs.200 (for 11 months) + Rs.300 (March) = Rs.2,500 yearly

For Self-Employed (PTEC)

Self-employed individuals pay a fixed annual professional tax based on their profession:

Sole Proprietors, CA, Doctors, Lawyers, Consultants, Freelancers, Business Owners

Annual PT Payable - Rs. 2,500 per year

Partnership Firms, LLPs, Companies

Annual PT Payable - Rs. 2,500 per year

Employers registered under PTRC must deduct and pay professional tax for male employees earning above Rs. 10,000 per month and female employees earning above Rs. 25,000 per month.

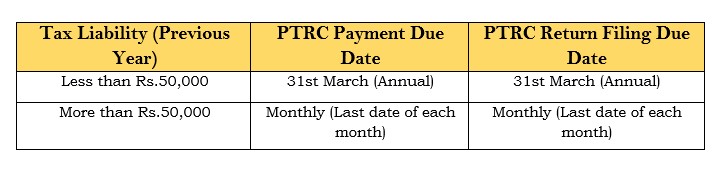

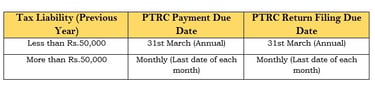

PTRC & PTEC Return Filing & Due Dates

| PTEC Payment Due Date | 31st March (Annually) |

Late Fees for PTRC Return Filing:

Within 30 Days of Due Date: Rs. 200 late fee if the return is filed within 30 days after the prescribed due date.

After 30 Days of Due Date: Rs. 1,000 late fee if the return is filed beyond 30 days of the prescribed due date.

Interest on Delayed PTRC Payment:

If there is a failure to deduct or pay professional tax, interest is charged at 1.25% per month on the outstanding PTRC liability until the default continues.

To avoid penalties, ensure timely filing of PTRC returns and payment of dues.

Benefits of PTRC & PTEC Registration

Legal Compliance – Avoid penalties for non-registration.

Easy Loan & Tenders Approval – Required for business loans & government tenders.

Employer Obligations – Ensures timely deduction & payment of employee PT.

Avoid Interest & Penalties – Non-payment leads to heavy fines.

Need Help with PTRC / PTEC Registration?

We at Clearline Professional Chartered Accountant provide:

PTRC & PTEC Registration in Maharashtra

Professional Tax Return Filing

Compliance & Consultancy Services

Services

Your trusted partner for financial success.

Support

Contact Us

+91-9975791135

© 2025. All rights reserved.